Providing powerful assistance for the risk and compliance through PCI DSS Compliance

Any organization that stores, processes or transmits credit card data needs to abide by the technical and operational requirements specified by the Payment Card Industry Data Security Standard (PCI DSS). All organizations irrespective of their size have to follow these rules.

A PCI DSS readiness assessment (Gap Analysis), helps in the identification of flaws in the organization's current system and recommends proper controls to be implemented. It helps in better understanding of weakness and responding to rapidly evolving security compliance obligations. This helps the organization develop a strategy and plan to achieve compliance.

This readiness assessment makes it easy to pass through the Qualified Security Assessors audit of the system, policies and procedures, controls and other areas of the organization.

Why is PCI DSS Compliance important?

Almost every organisation is at risk of fraud and identity theft with the increasing cybercrimes. Data breaches not only harm a business but the associated customers as well. Getting compliant will help in reducing costs, data breaches, prevention from fines, loss of customers' trust etc.

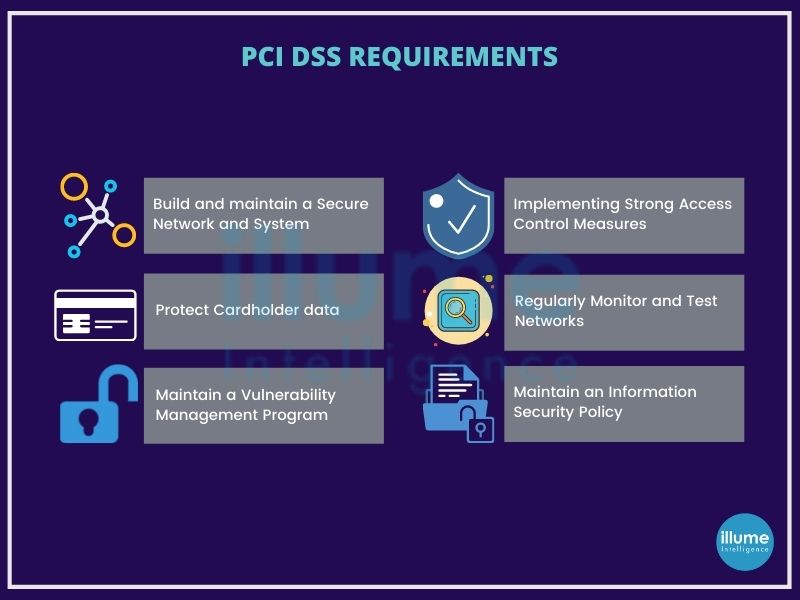

What are the requirements of PCI DSS?

PCI SSC sets both operational and technical requirements with the core focus to protect cardholder data. The 12 requirements are -

1. Install and maintain a firewall configuration to protect cardholder data.

2. Do not use default passwords for the system and other security parameters.

3. Protect stored cardholder data.

4. Encrypt transmission of cardholder data across open, public networks.

5. Use and regularly update anti-virus software or programs

6. Develop and maintain secure systems and applications.

7. Restrict access to cardholder data by businesses that need to know.

8. Assign a unique ID to each person with computer access.

9. Restrict physical access to cardholder data

10. Track and monitor all access to network resources and cardholder data.

11. Regularly test security systems and processes.

12. Maintain a policy that addresses information security for all personnel.

It is advised to define the PCI DSS scope. It is crucial to reduce the PCI DSS audit scope because it will determine the compliance costs, operational costs and risks associated.

Get our expert team to assist you today with your PCI DSS Compliance Preparedness.